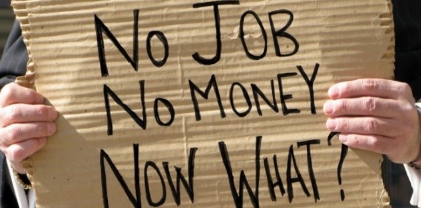

Corporate America fires 13% of workforce, creates fewer jobs amid recession fears

12/06/2022 / By Belle Carter

Giant companies in the U.S. resorted to mass layoffs in preparation for an eventual economic recession. Moreover, they were also slow to hire and create jobs over the past few months.

In October alone, 13 percent of employees were laid off – the highest jump since February 2021. Job creation and hiring also slowed down since January 2021, with only 127,000 work opportunities created in October – nearly half the 239,000 jobs created in that month, and much less than analysts expected.

The Wuhan coronavirus (COVID-19) pandemic has set a growth opportunity for some companies, particularly those in tech and e-commerce. Customers stuck at home came to rely on delivery services like e-commerce and virtual connections formed through social media and videoconferencing. However, tech firms are now starting to decrease spending as their financial chiefs fear the “trying times.”

Meta CEO Mark Zuckerberg recently announced a huge layoff, admitting to his employees that he “got it wrong” and that he “takes responsibility” for the problems that led to the cuts, which made up around 11,000 jobs or 13 percent of its workforce. (Related: Meta’s Mark Zuckerberg fires more than 11K employees, takes blame for overestimating company’s growth prospects.)

Following Elon Musk’s acquisition of Twitter, he went on to terminate top executives and let go of 3,000 employees in the microblogging company. Some left independently, while others were forced out.

Amazon, considered the largest company in the world by revenue, announced that it would lay off around 10,000 employees in various facilities that employ data scientists, software engineers and other corporate workers, accounting for three percent of the retail giant’s corporate employees and less than one percent of its overall global workforce. The company currently employs more than 1.5 million people.

The other firms that announced job cuts are:

- DoorDash – 1,250 employees

- AMC Networks – 1,700 employees

- Microsoft – around 1,000 employees

- Lyft – around 700 employees

- Stripe Payments – 1,100 employees

- Seagate Technology – 3,000 employees

- Cisco Systems – 4,100 employees

- HP – 6,000 employees

Fed: Rate hikes the only way to tame inflation

Musk and other business figures like JPMorgan’s Jamie Dimon, Goldman Sachs’ David Solomon and Amazon’s Jeff Bezos have expressed concerns that the U.S. is plunging into a recession as a result of higher interest rates.

According to the Tesla and Twitter CEO, the U.S. Federal Reserve’s attempts to bring down inflation by hiking interest rates could make it worse. “[The] Fed needs to cut interest rates immediately,” Musk tweeted. “They are massively amplifying the probability of a severe recession.”

Jerome Powell, the U.S. Fed’s chairman, said during the November Federal Open Market Committee meeting that the central bank is preparing to slow the pace of interest rate rises while it tackles a 40-year high in inflation. But he also stressed that the smaller hike should not be taken as a sign the Fed will let up on its inflation fight anytime soon as there was “more ground to cover.” He added that rates would stay higher for an extended period.

The Fed may increase its key interest rate by a smaller increment at its December meeting – only a half-point after four straight three-quarter point hikes. “It is likely that restoring price stability will require holding [interest rates] at a restrictive level for some time,” Powell said during a speech at the Brookings Institution. “History cautions strongly against prematurely loosening policy.”

Visit EconomicRiot.com for more news about the looming recession in the U.S.

Watch this G News report about about Amazon’s biggest workforce layoff.

This video is from the Chinese taking down EVIL CCP channel on Brighteon.com.

More related stories:

Meta plans to sack thousands of employees amid severe drop in revenue.

Amazon to fire 10,000 employees in biggest layoff in company’s history.

Sources include:

Submit a correction >>

Tagged Under:

Big Tech, Bubble, Collapse, covid-19, debt bomb, debt collapse, economic collapse, Elon Musk, Inflation, jobs, layoffs, mark zuckerberg, market crash, pandemic, recession, retrenchment, risk, tech giants, tech sector

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BUBBLE NEWS