Coronavirus lockdowns expose the financial fragility of the modern American lifestyle

03/24/2020 / By Lance D Johnson

When the first coronavirus cases showed up in the United States, nearly 80 percent of workers were living paycheck to paycheck. About 60 percent of Americans couldn’t afford an unexpected $1,000 expense due to mounting personal debt and very little savings. For years, Americans consumed everything they earned, while barely preparing at all for the obvious instabilities that exist with the modern American lifestyle.

Most Americans live in a precarious bubble, unprepared for inevitable financial instability

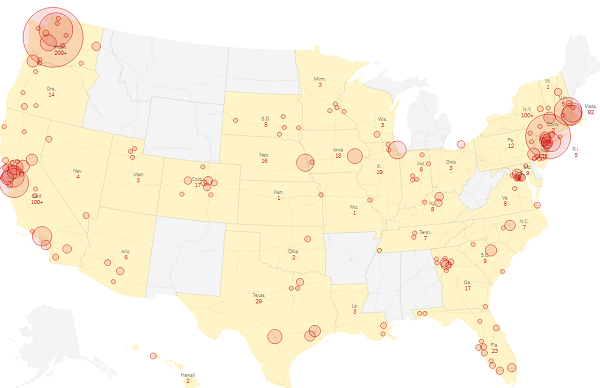

Now, after states have shut down large portions of the economy for two weeks, about one fifth of low wage earners have either lost their jobs entirely or have been forced to accept reduced hours. Many are worried about their finances, their security, and their future way of life as governments shut down large parts of the economy indefinitely to “slow the curve” of coronavirus.

These state-wide shutdowns have placed a tremendous amount of stress on most Americans, and while this is understandable, most Americans have never attempted to prepare for widespread disruptions to their way of life. Many have never had to prepare, never thought of preparing, were never trained to prepare, and were only told that prepping was needless “fear-mongering.” With credit cards in hand and new age theories in their heads, many young Americans were taught that everything is awesome, that the government or the universe would take care of us all. Now, after two weeks of shutdown and mass layoffs, most Americans are begging the government for bailouts, as hyper-inflation, higher taxes, homelessness, and bankruptcy lingers on the horizon.

In the coming months, many higher paid salaried workers will be laid off as companies “cut the fat.” Companies will issue furloughs that will temporarily, or permanently, wipe out higher earners. This will force many middle class Americans to reduce their consumption habits and think about what really matters in life. Heavily invested in the stock market, this group will realize that they never invested in things that really matter to their survival, their sovereignty, or their ability to sustain civility and community during a crisis; that’s why many rushed to panic-buy toilet paper, diaper wipes, groceries, and booze as the situation became more volatile.

Today’s population will soon learn what matters, why it’s important to prepare

Before the shutdowns, most Americans could barely keep up with the cost of the modern American lifestyle as it was — reaching for lines of credit to sustain their livelihood. Easy credit has given Americans an illusion of wealth as they gained access to nice homes, career promises, expensive vehicles and needless consumer products and digital gadgets. But as the bubble grew, hardly anyone planned ahead and prepared for emergencies, economic uncertainties and inevitable collapse of vulnerable systems. In fact, consumer debt has surpassed $14 trillion and will continue to climb as jobless people search — this time around — for ways to pay for food and necessities.

Not many people are financially prepared to live through a state-wide lock down, let alone a long term crisis. Like previous generations that endured the Great Depression and World War II, this generation will soon be forced to live within their own means. Americans will soon have to learn how to save money, how to fix what they have, how to prepare their food pantry, how to grow food, and how to stay mentally tough during stressful times. Americans have a civic responsibility to learn how to feed and protect their own families and how to strengthen their immune systems to stay healthy during pandemics, to ultimately protect the old and weak.

Sources include:

Tagged Under: Americans, Collapse, easy credit, Economic Uncertainty, economics, emergencies, emergency, finance, finances, households, Hyper Inflation, necessities, no savings, outbreak, pandemic, panic, paychecks, preparedness, responsibility, SHTF, sovereignty

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BUBBLE NEWS