America heading toward a housing market crash worse than the Great Recession

09/28/2023 / By Arsenio Toledo

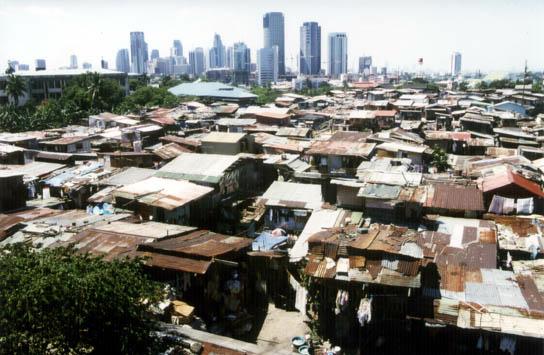

The American housing market is heading for a crash that may be bigger than the one experienced by homeowners in the 2008 financial crisis.

“This will be the greatest crash in the history of housing,” warned financial expert John Perez, who predicted that, following the crash, average housing prices across the country could plummet by 50 to 70 percent, bringing prices down to pre-1995 levels. “This is going to be a wipeout like we’ve never seen before.” (Related: Nearly 800,000 Californians behind on rent, with over $5B accumulated rental debts.)

Fannie Mae, a government-backed mortgage financing corporation, forecasted total home sales to slump to just 4.8 million by the end of the year – the slowest sales environment in the United States since 2011. If the housing crash doesn’t happen by 2024, Fannie Mae economists estimate that this figure will barely improve, with total home sales only expected to hit 4.9 million in 2024.

The slump in sales has been attributed to massively high mortgage rates, with the average rate on the 30-year fixed mortgage soaring to as high as 7.18 percent over the second week of September. Perez noted that these high rates are making demand for mortgages drop to its lowest level since 1995.

“And it’s falling sharply,” he added. “Mortgage demand is down 60 percent. Meanwhile, existing home sales are down 16 percent already this year, their lowest since 2010. No one wants to sell and no one wants to buy.”

The median price for existing homes back in August was around $407,000, according to the National Association of Realtors (NAR), around four percent higher than a year ago. Many buyers are still on the market competing for the few homes available, but the NAR noted that it is actually seeing a drop in the number of completed sales, with prospective buyers frustrated with the increasing costs of financing a home.

Housing prices dropping in many parts of the U.S.

While average home prices are still high, prices in many housing markets in the country are actually dropping, especially in some of the country’s largest metro areas.

Austin saw the biggest drop in prices at 11.4 percent, followed by New Orleans at 8.4 percent and Phoenix and Las Vegas at 6.4 percent each. They are followed by San Francisco and Salt Lake City, which saw prices drop by 4.2 percent each, and by Sacramento which saw a 3.8 percent drop in prices.

Other major markets that saw more modest price decreases of between 2.7 to 0.3 percent are Nashville, San Antonio, Denver, Seattle, Dallas, Jacksonville, Raleigh, Portland, Tampa, Houston, Memphis, Riverside, San Jose and Charlotte.

The depreciation in housing prices in these 21 different housing markets all occurred in just one month and were recorded by real-estate platform Zillow, which noted that other housing markets like Hartford, Buffalo, San Diego, Cleveland and Providence saw prices go up month-over-month in August.

Home prices in August saw an overall increase of 0.2 percent, which Zillow described as a massive cooling after “red-hot” gains in housing prices over the last three months, indicating a decline in demand for houses in the United States.

“After housing market demand and activity peaked for the year in May and June, conditions have loosened in the later phase of summer,” noted Jeff Tucker, a senior economist at Zillow. “Not only did price growth decelerate, but closed-sales data from July showed fewer homes selling above their list price.”

U.S. economy plummeting along with housing

As the housing market continues to weaken, the rest of the U.S. economy is also declining with it.

The latest credit card transaction data and auto sales data show that U.S. consumers are becoming more wary of making purchases. In August, car sales fell by 4.6 percent. The personal savings rate also dipped to 3.5 percent in July. These factors, coupled with the fact that wage growth has slowed tremendously, show that the U.S. economy is about to enter a recession.

Even if the U.S. avoids a recession within the next year, Fannie Mae economists noted that the housing market will be struggling for “a long time.” This situation will be made worse if the Federal Reserve keeps interest rates high, with other experts arguing that housing affordability and sales are unlikely to improve until mortgage rates are dialed back to around the five percent range.

Learn more about the state of the American housing market at HousingBomb.com.

Watch this episode of “Man in America” with host Seth Holehouse as he interviews financial expert John Perez about the coming collapse in housing prices in the United States.

This video is from the Man in America channel on Brighteon.com.

More related stories:

RFK Jr. to push for government-guaranteed 3% mortgage if elected president.

BAD NEWS for home buyers: U.S. house mortgage rates SKYROCKET to HIGHEST level in two decades.

HOMELESSNESS in the U.S. reaches RECORD HIGH amid worsening economic downturn post-pandemic.

Airbnb listing revenue COLLAPSES, driving fears of housing market crash.

US home foreclosures SURGE as inflation continues to soar and incomes decline.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, debt bomb, debt collapse, economic collapse, economic riot, economics, economy, finance riot, financial crash, housing bomb, housing prices, Inflation, market crash, money supply, mortgage rates, mortgages, pensions, recession, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BUBBLE NEWS