Alarming study: 60% of Americans are still living paycheck to paycheck amid soaring inflation and rising interest rates

10/03/2023 / By Laura Harris

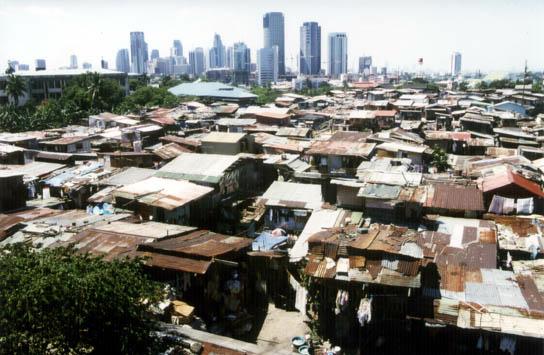

A new study conducted by LendingClub has found that 60 percent of Americans are still living hand to mouth or paycheck to paycheck, as wages stagnate amid soaring inflation and rising interest rates.

According to LendingClub, the number of Americans still struggling paycheck to paycheck has remained at around the same level since 2022. In July, 76 percent of consumers earning less than $50,000 a year said they were living paycheck to paycheck. Sixty-two percent of those who earned between $50,000 and $10,000 annually and 45 percent of those earning more than $100,000 a year also said they were living paycheck to paycheck.

This data is close to the average of 61 percent of adults living in the same situation in June and from LendingClub’s data in 2022.

Meanwhile, the data released by the Bureau of Labor Statistics (BLS) in August reveals that inflation has slowed down only marginally, but goods and services are still 3.7 percent more expensive. A separate report released by the Department of Labor shows that hourly wages have gone down by 0.5 percent month-over-month.

“The data underscores the pervasive nature of financial challenges affecting a majority of consumers. The problem is that there is more month at the end of the money,” stated Alia Dudum, a money expert from LendingClub. (Related: Nearly two-thirds of Americans are now living paycheck to paycheck amid inflation crisis.)

As a result, American households find it hard to manage their expenses because their wages are not increasing as fast as prices. They solely rely on their regular incomes to cover essential living expenses.

Low-wage earners struggle to make ends meet amid soaring inflation and interest rates

In a 2015 report released by the Economic Policy Institute, 90 percent of low-wage earners only had a 15 percent increase in their pay since 1979 compared to the 138 increase of the top one percent of earners. These deep historical roots, in return, create wage-earner anxiety due to the surging inflation and rising interest rates.

For instance, based on the latest data from BLS, a typical worker could take home $3,308 per month after tax and benefit deductions.

But aside from deductions, one must also pay monthly rent, which is about $2,029 based on Redfin. Meanwhile, a mortgage payment for a 2,400–square-foot house is $1,957 per month in the first quarter of 2023, according to the Council for Community and Economic Research.

“Inflation is really hurting individuals having stability in their housing. If you have uncertainty in your housing, it causes uncertainty everywhere,” stated Kamila Elliott, co-founder and CEO of Collective Wealth Partners in Atlanta.

Not to mention the average monthly expenses of $690.75 for food and $96.42 for out-of-pocket health expenditures. So, the total monthly expense could probably rise to $2,816.17 for renters and $2,744.17 for homeowners. Other essential expenses like transportation, child care and debt payments are still not yet included in the computation.

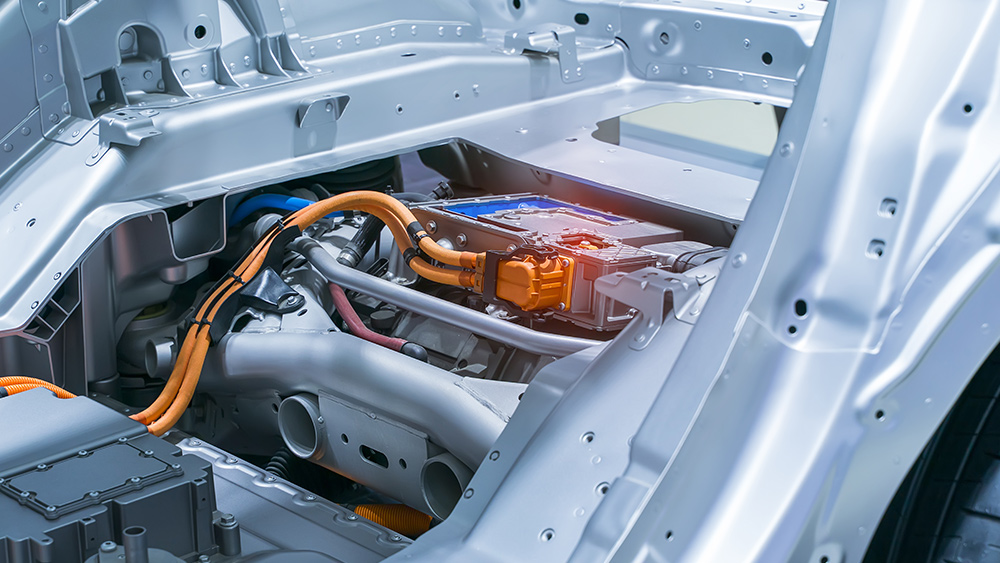

Moreover, the burden of higher interest rates on credit card debt and auto loans contributes to the pressure on their household budgets as noted by Sophia Bera Daigle, the CEO and founder of Gen Y Planning, an Austin, Texas-based financial planning firm. Thus, “monthly expenses are starting to hurt,” Daigle stated.

That breakdown shows why lower-income workers feel financially strained.

Visit DebtCollapse.com for more news about the declining state of American economy.

Watch this video about how inflation impacts the lives of Americans.

This video is from Worldview Report channel on Brighteon.com.

More related stories:

Most American adults living paycheck to paycheck, report finds.

6 out of 10 Americans still living paycheck to paycheck despite spending cutbacks.

Nearly two-thirds of Americans are now living paycheck to paycheck amid inflation crisis.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, chaos, Collapse, debt bomb, debt collapse, economic riot, finance riot, household debt, Inflation, market crash, money supply, panic, poverty, risk, wages

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 BUBBLE NEWS